Mobile User Survey Shows Who Has the Best Customers

Upon initial inspection of the data, analysts were surprised by the lack of diversity across carriers' subscriber bases. All carriers scored high on customer satisfaction questions, and interest levels in new services were relatively consistent across carriers (responses from Sprint PCS customers, however, were always well above average). This lack of diversity leads us to believe that each carrier is targeting multiple market segments. Redmond, WA-based AT&T, for example, may focus primarily on the high-end business user, but the company still has offers (like its prepaid and family plans) aimed at residential customers.

Here are some highlights from the survey:

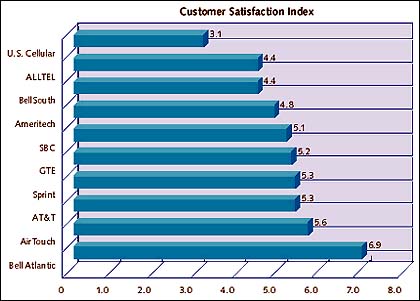

- Bell Atlantic Mobile (BAM; Bedminster, NJ) customers reported the highest levels of service satisfaction in the industry (see Figure 1).

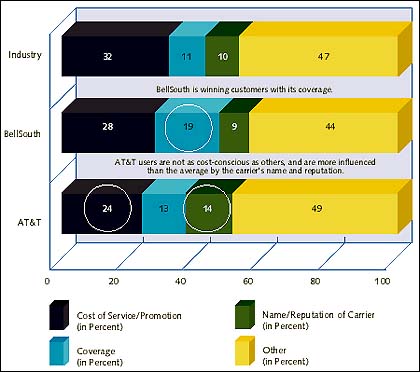

- BellSouth Mobility (Atlanta, GA) customers are twice as likely as other users to have considered coverage and service reliability as the most important factors when choosing a carrier.

- In general, brand and reputation did not win many customers (only 10%), but AT&T Wireless did win 14% of its customers with its strong brand appeal.

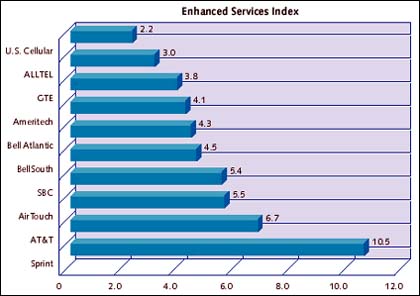

- The survey also revealed that Kansas City, MO-based Sprint PCS customers are the leaders in replacing wireline usage. Sprint PCS customers are also far more interested than the average user in enhanced service:

- Sprint PCS customers are almost twice as likely to have wireless e-mail capabilities (12% believe they can receive e-mail compared to the 7% average), and of those who do not have wireless e-mail capabilities, 35% are interested in acquiring messaging services (compared to the 15% industry-wide interest level).

- Wireline displacement and replacement levels by Sprint PCS customers are more than 50% above average. Also, Sprint PCS customers expect more displacement in the future.

- The analysts asked the sample of wireless users to name "three things wireless carriers could offer to keep your loyalty." Almost 70% listed "reduce service prices," but only 17% of the respondents claimed that carriers had proactively offered better, more competitive rate plans. GTE (Atlanta, GA), Bell Atlantic Mobile, and Alltel (Little Rock, AR) were more aggressive than others on this front.

Figure 1. "5" represents average usage and interest levels in an index of enhanced services. Each point above (or below) the mean implies that customers are 10% more (or less) likely to be interested in, or to already have, enhanced services. A "10," for example, implies that customers are 50% more likely to be interested in acquiring, or already have, enhanced services.

Figure 2. Similar to the Enhanced Services Index, "5" represents average overall customer satisfaction,"6" means that satisfaction levels are 5% above average, and so on.

Following is a look at the customer service section of the report:

Keeping the Customer

A good customer is cheap to acquire, interested in new services, and uses the phone all day. Then comes the challenge of keeping those customers delighted and loyal. In the survey, analysts asked users about customer care, customer satisfaction, and churn. If everything else were held constant, one would expect to find evidence of the following relationship: excellent customer care leads to satisfied customers, and results in lower churn. Everything else is not constant, however.

In particular, the characteristics of a carrier's subscriber base and the competition in a market can make it more or less difficult to hold on to customers. Sprint, for example, scores higher than Chicago-based Ameritech in most measures of customer satisfaction. Nevertheless, Sprint customers are three times more likely to have been "very close to canceling wireless phone service in the past year." Sprint customers are also twice as likely to have actually changed carriers in the past year and three times more likely than the average user to have changed service multiple times. For a well-rounded understanding of churn, consider both the attributes of a carrier's customer base and the carrier's efforts to provide customer care.

The Effect of Customer Care on Churn

Of the 402 users in the survey who changed carriers in the past year, only 4% claimed that they did so because of better customer service (GTE was exceptional and won 11% of its "churners" with better customer care). One-third of these 402 changed service because their current carrier offered a better deal (see Figure 3). Carriers could have saved many of these churners with preventative customer care: loyalty programs, subsidized digital upgrades, and economical roaming packages.

Figure 3. How Carriers Won Their Customers—Percentage of respondents who claimed that cost of service, etc. was the main reason for choosing their current carrier.

Carriers must have a customer sales representative (CSR) available without a long wait. Only 10% of cellular customers had to wait five minutes or more when making calls to their carriers, but 21% of PCS customers suffered this inconvenience (one of their thoughts while waiting probably involved changing carriers). Carriers should do everything they can to ward off calls in the first place: bills should be simple to understand, and the service should work. On average, 6% of users find it necessary to call customer service 6 times per year. BellSouth and Sprint customers are the most likely to make repeat calls.

Fortunately for Sprint, 43% of its customers (compared to the 32% average) are interested in using the Internet to review billing information. This should help the carrier reduce CSR time. The rural customer bases of U.S. Cellular (Chicago) and Alltel are relatively uninterested in using the Internet to review their bills (only 25% and 26%, respectively, are interested).

Although the analysts view the Internet as an increasingly significant solution for customer care challenges and as an opportunity for wireless sales, only 6% of users have visited their carrier's Web site in the past year. PCS subscribers visit twice as often as the average and 10% of SBC customers have visited their carrier's site. Carriers should pay particular attention to these Web visitors, because almost half of them also claimed to have checked competitors' Web pages in the past year. These Web surfers are also valuable customers, with average revenue per unit (ARPU) 30% above average.

Customer satisfaction

Almost 90% of users are satisfied with their overall service, including 53% who are very satisfied. The principal reason for the industry's high satisfaction score is network improvement. Nearly one-third of all users found that coverage and network reliability have improved over the past year, and only 11% of the respondents who recently churned cited coverage as the main reason. Users will eventually take network reliability for granted, and as new customers enter a world of ubiquitous coverage, expectations will rise. Inevitably, satisfaction levels will probably fall again as customers will expect wireline quality from their wireless providers.

Here are some carrier-specific customer satisfaction results:

- Almost half of all Sprint customers (45%) have found that coverage has improved in the past year, and only 6% think coverage has deteriorated (on average, 30% saw improvement and only 3% witnessed network deterioration).

- U.S. Cellular and Alltel have relatively few customers who are "very satisfied" with overall service (42% and 48% respectively), while Bell Atlantic customers were most likely to be "very satisfied" (63%).

- Coverage may have improved, but there is still ample room to grow: only 31% of users gave carriers an excellent coverage and network reliability rating, as follows:

- On average, 15% responded that coverage is fair or poor, including 20% of Alltel and 24% of U.S. Cellular subscribers.

- AT&T, Bell Atlantic, and BellSouth are exceptional in impressing customers with their network coverage (37% of all of their customers claimed that coverage was excellent).

- SBC customers were pleased with coverage in the Southwestern Bell area (36% reported excellent coverage), but less satisfied in the company's CellularOne region (only 29% reported excellent coverage).

- Feature offerings impressed 26% of users sufficiently for an excellent rating, and 34% of Sprint customers claimed that their feature offerings were excellent.

- Customer service ratings hardly varied, with just under 30% of most carriers' subscriber bases giving an "excellent" rating. SBC's Southwestern Bell customers were the least satisfied with customer service, and only 20% reported excellent customer service.

Churn

In the past year, 26% of wireless users came close to canceling their service, including 11% who came "very close." Sprint, in particular, had a very tenuous hold on its customers: 29% considered canceling service, including 18% who came "very close." Sprint customers are not bound by a contract and thus have the option of churning at any time. Also, the company's rapidly expanding customer base is loaded with new wireless users whose loyalty may last only as long as the latest promotion.

A high percentage of U.S. Cellular subscribers (33%) also considered churning. This fickle behavior is unexpected because U.S. Cellular's rurally based subscribers can only choose from two or three competitors. Many of these customers are looking for lower prices.

The Alltel subscriber, as might be expected of a rural subscriber with few competitors to choose from, seems relatively complacent (only 23% considered canceling service in the past year). Among the cellular carriers, Ameritech has held its subscribers tightly, with only 18% on the fence, including a palatable 6% who came "very close" to falling off and churning.

The analysts also asked the sample of wireless users to name "three things wireless carriers could offer to keep your loyalty." Almost 70% listed "reduce service prices," and about 40% listed "improve coverage," "offer loyalty programs," and "offer phone upgrade program." Only 17% of the respondents, however, claimed that carriers had proactively offered better, more competitive rate plans. GTE, Bell Atlantic, and Alltel were all more aggressive on this front (24%, 21%, and 22%, respectively), while only 14% of the PCS subscribers had received proactive offers. PCS companies are generally unable to make their (already low-priced) packages more economical.

The cellular carriers, however, may still have high-value customers on outdated, expensive plans. The incumbents need to lock these customers in with better rates and incentives before PCS carriers can steal them away.

Conclusion

The survey results have shown that carriers' subscriber bases are more homogeneous than the analysts had previously expected. Next year, certain carrier-specific characteristics should become even more homogeneous as four to seven national carriers emerge with similar footprints. As networks expand and PCS customer care centers learn to handle their call flows, customer satisfaction levels will continue to coalesce. Lifestyle and usage differences will emerge as the carriers distinguish themselves with new data services and pricing options (like prepaid). The new offers should refocus the carriers on particular segments and form the basis for the next round of wireless competition.

For more information, contact The Yankee Group at 617-956-5000.